Computer depreciation rate

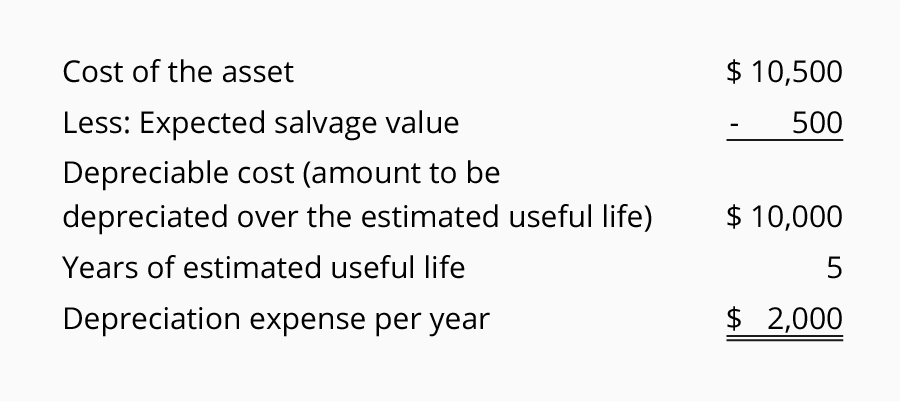

Alternatively you can depreciate the acquisition cost over a 5-year. This could be on a straight-line basis which writes the asset off at 25 of.

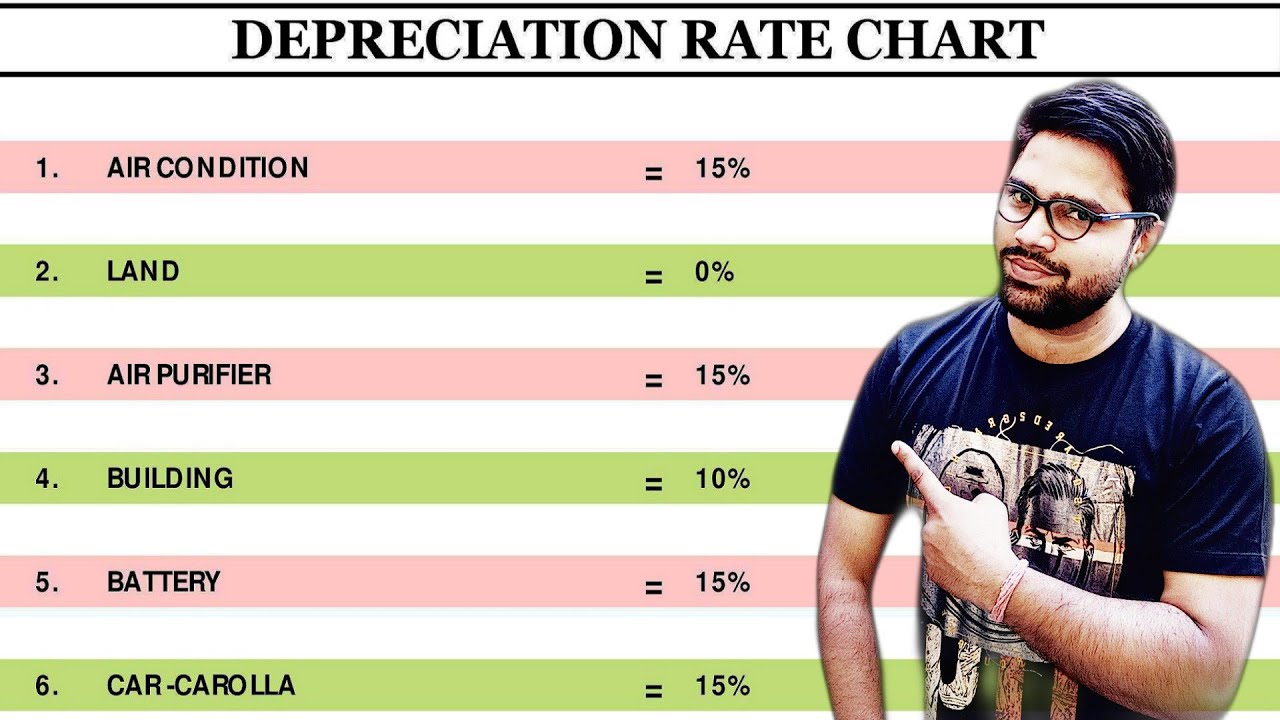

Dep Rate Chart Depreciation Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Youtube

First add the number of useful years together to get the denominator 1234515.

. Class 1 4 Class 3 5. That means while calculating taxable business income assessee can claim deduction of. You need to know the full title Guide to depreciating assets 2022 of the publication to use this service.

153 rows Computer-to-plate CtP platesetters including thermal and visible. The formula to calculate depreciation through the double-declining method is. Applicable from the Assessment year 2004-05.

Then depreciate 515 of the assets cost the first year 415 the second year. Use our automated self-help publications ordering service at any time. The rate of depreciation on computers and computer software is 40.

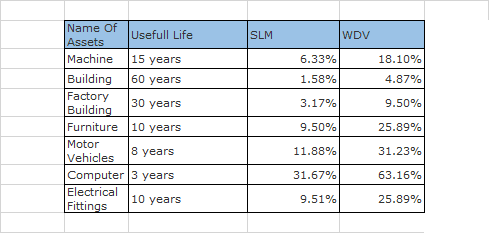

If a company uses Written Down Value WDV method of depreciation it will need to calculate a new rate for depreciation to depreciate the asset over their remaining useful life. At the end of the 3 years the. Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation.

What is a sensible depreciation rate for laptops and computers. Computer depreciation rate This method starts by assuming a factor of depreciation rate as a percentage and each year the assets book value is depreciated by that percentage. How to Calculate Depreciation Using the Straight Line Method.

You have purchased a computer for 1000 and estimate you will keep it for 3 years. 170 rows Rate of depreciation shall be 40 if conditions of Rule 52 are satisfied. A good and oft-used rate is 25.

The special depreciation allowance is 100 for qualified property acquired and placed in service after September 27 2017. We also list most of the classes and rates at CCA classes. Below we present the more common classes of depreciable properties and their rates.

Office equipment computers laptop notebook gateway compaq dell pc computer drive cd rom desktop. Office Equipment - Computers Depreciation Rate. 2500 per year Keywords.

Depreciation Calculator For Companies Act 2013 Taxaj

Depreciation On Equipment Definition Calculation Examples

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

How Long Does A Gaming Pc Last Statistics

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Accountingcoach

Projectmanagement Com What Is Depreciation

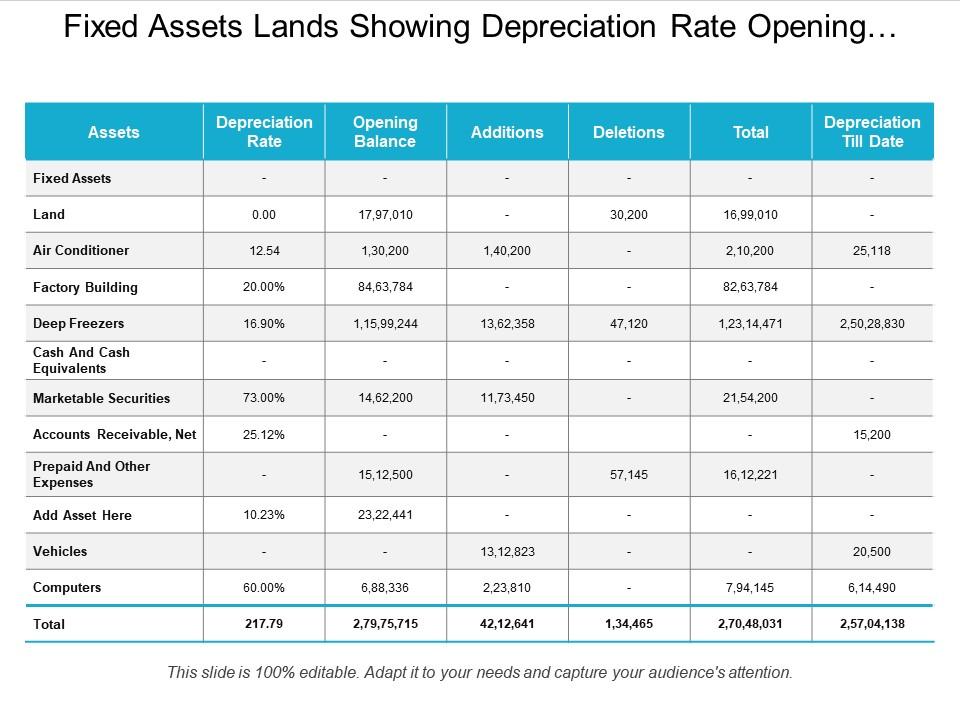

Fixed Assets Showing Depreciation Rate Opening Balance And Addition Templates Powerpoint Slides Ppt Presentation Backgrounds Backgrounds Presentation Themes

Computer Related Equipment Depreciation Calculation Depreciation Guru

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Depreciation Rates Of Investments Download Table

How Long Does A Gaming Pc Last Statistics